How to Sell your Business for MORE, Today!

In this Business Sale Tutorial, we’re going to show you how you can turn an unprofitable business, worth nothing on paper, into a business with a great Sale Price in minutes!

Forget if your business has “plenty of cash”, or “it has so much potential”, or “you’ve spent millions on it”.

The fact is two Rules come to the top every time:

(1) you need to show a profit which is more than the average wage that your prospective buyer can earn, and

(2) you need to offer a good Return on Investment (ROI) in line with similar businesses.

Every business is different and needs to be assessed on a case by case scenario so we want you to be able to filter what we show you in this Tutorial and apply what is applicable to your own business.

If you’re still scratching your head afterwards, just give us a call or flick us an email and we can help you personally. That’s not a problem.

So, let’s show you how to put profit back into your business.

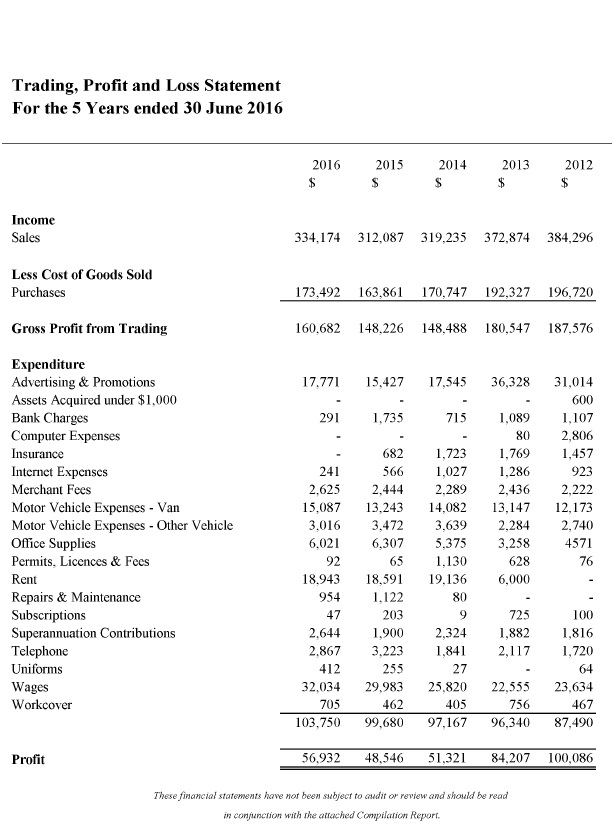

Grab your Trading Account, also known as your Profit & Loss Statement for the past 3 years. If you haven’t traded for at least 3 years, then grab the last 1 or 2 years. These should have already been prepared by your Accountant (see “Image 1”).

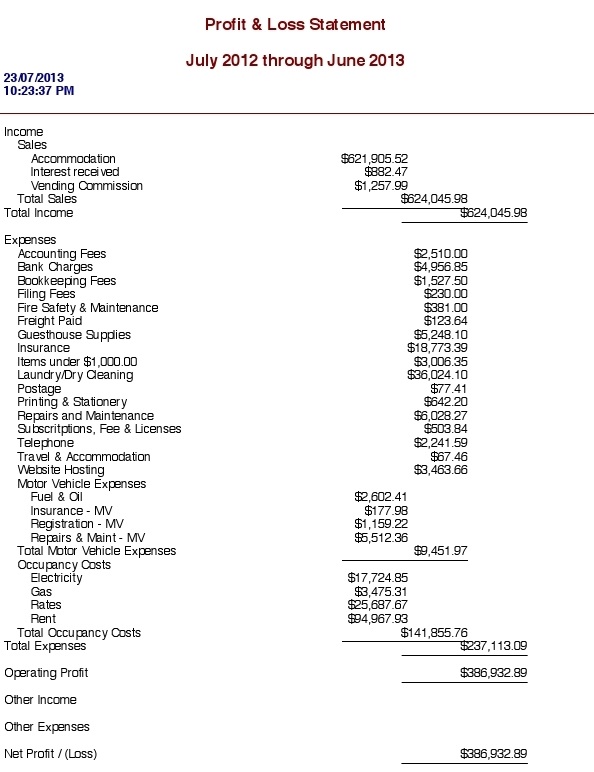

Now, grab your internal Management Trading Accounts or internal Profit & Loss Statements for the corresponding periods (see Image 2).

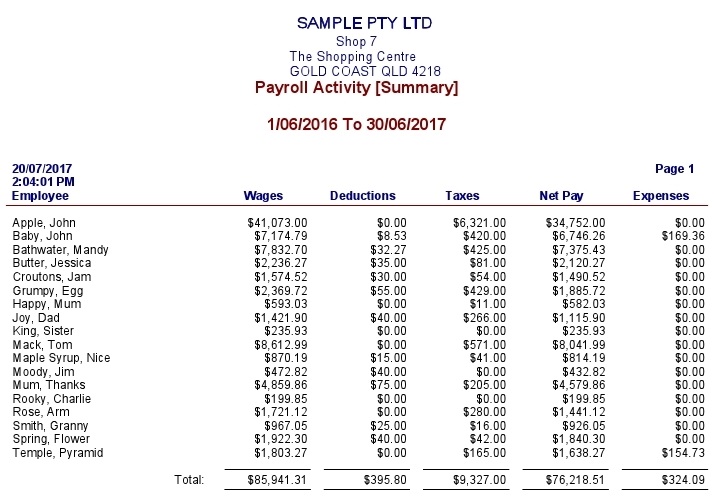

Now, grab you Payroll Summary for the corresponding periods. It should show the wages and superannuation paid to each employee on PAYG (see “Image 3”).

If you look at your Management Accounts, you’ll probably see that it itemises your Income and Expenses in more detail than your Accountant’s set of Accounts.

In your Income section, identify any items where you have entered Income that was generated from non-business, or non-trading activities. This might be items such as Interest earnt or rental income from another property.

If these items have been included in your Accountant’s set of Accounts then these should be removed from your Trading Income as they were NOT Income derived from your normal trading activities, and will NOT or are UNLIKELY to appear again in a normal trading year A new Owner will not benefit from this Income so it should be removed to appreciate the true trading performance of the business in a normal trading year.

Now we need to go through your operating Expenses. Look at your Cost of Goods, Cost of Manufacturing, and your other Expenses. Identify all the entries that were put through the books that were not necessary in the operation of the business.

In other words, if you had NOT spent that money and you did NOT need to spend it to run your business, then in their absence, it would NOT have affected your operations and did NOT bring in Income.

These might be personal, once-off, or discretionary expenses such as personal overseas travel, personal Motor Vehicle, or donations. If you think removing it might be contested, you’re better to leave it in.

If you spent money on a failed advertising campaign or hired staff that are now redundant, then unfortunately, these must remain on your books as even though in hein site you feel that it was a waste of money and bought in no Income to the business… it was still money you spent to run your business with the intention of bringing in Income so you can’t do anything about that. Leave it there.

Now, run through your Payroll Summary and identify anyone who is a non-working Owner or non-working family member receiving a wage. These people can be removed from your operating expenses as they have nothing to do with running your business.

Now look for wages made for one working Owner. You can also remove this from your operating expenses. What we want to see is how much profit the business makes before paying one Working Full Time Owner working a normal 38 hour to 40 hour week.

If we leave the wage for one working Full Time Owner, we are effectively showing a profit to the business run under management as you are in fact allowing wages to be paid for someone to work the Owner’s role. So in order to appreciate the trading profit to one working Full Time Owner, you need to take out their wage.

Once you have identified all the Income and expense that are personal, once-off, discretionary, or non-trading you can now produce a Special Purpose Report called a Bridged or Normalised set of Trading Accounts or Profit & Loss Statement which shows only the Income and Expenses relevant to the business.

This allows us to appreciate the true trading position of the business to one Working Full Time Owner. It’s best your Accountant produces this Special Purpose Report for greater credibility.

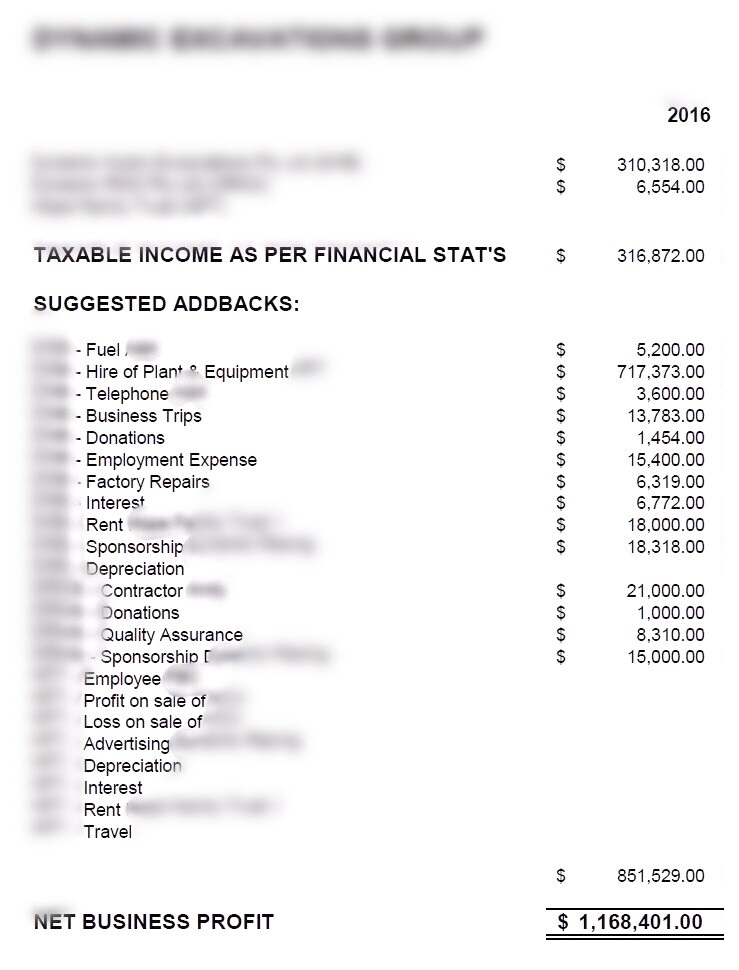

The other option is to produce an Addback Schedule which is set out like your Profit & Loss Statement itemising each adjustment and the amounts for each (see Image 4). You can do this yourself. Both will have the same effect.

If you have no adjustments to make to the Income and/or Expenses then unfortunately your Net Profit position will be unchanged.

However, if you have removed more Expenses than Income, then your Net Profit should now be higher than your reported Profit, and you can now apply a valuation formula to your business that results in more than zero and higher than a Fire Sale!

If you’re not sure if this is legal or acceptable Accounting practice, then just ask your Accountant. What you need to be mindful of is not getting carried away with the amount of expenses you remove from your financials. Too many adjustments that you can’t substantiate with accurate reporting can look dodgy and scare off buyers.

If you don’t want to provide a Special Purpose set of Accounts to a Buyer then unfortunately, you will have to rely on the ones you have prepared for the Tax Office and BAS Statements.

Every business is different and you can’t make an adjustment for one business and necessarily apply the same adjustment for another.

Sadly not all Accountant’s understand how to make proper adjustments for sale as they can be influenced by pleasing their Client (the Seller), or simply have little to no idea of what is acceptable and non-acceptable for THAT business; so they make adjustments that, when reviewed by the Buyer’s Accountant or Lender, are rejected.

If you would like us to help you prepare an Addback Schedule which is in line with market expectations, or want to have a no obligation chat with one of our Consultants, please get in contact with us by email at sales@businessforsaleqld.com.au (you can still run it past your Accountant for their final tick of approval but let’s see if we can save you some time, money and embarrassment by getting your ducks lined up first).

If you liked this Tutorial, please SHARE with others and we can bring you more great Tutorials. Likewise, if you have any burning topics you’d like us to cover, we welcome your suggestion. Just send us an email or message and we’ll take it on board.

DISCLAIMER

The information contained in this post is an opinion based on past experience. Do not take this as financial advice.